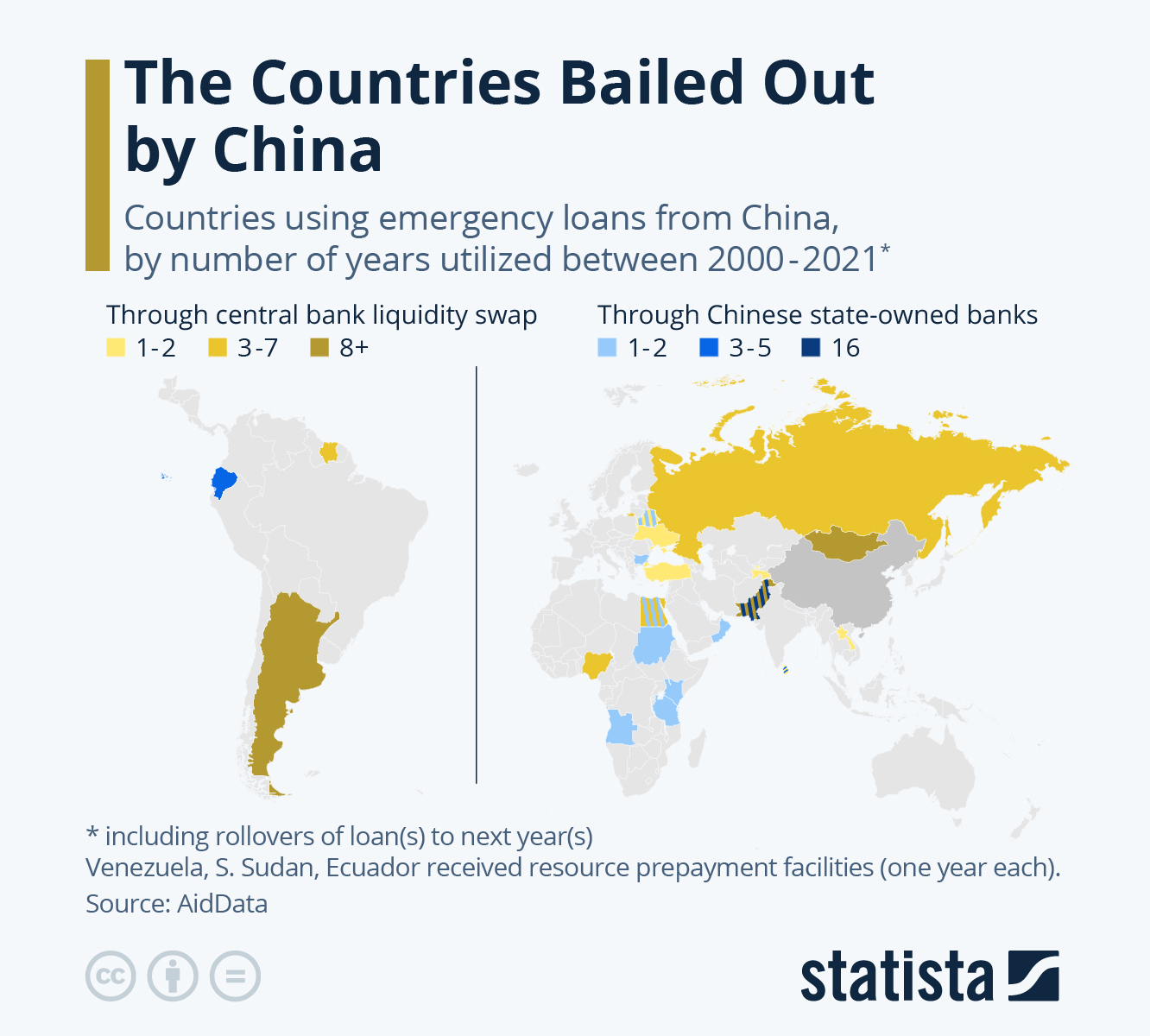

China has started to emerge as a veritable superpower, but it is doing this in a variety of subtle ways. Economic dealings have been a core part of China’s strategy because of the fact that this is the sort of thing that could potentially end up bringing more countries into its sphere of influence. Research that was just published by AidData revealed that there are 22 countries that China has bailed out.

With all of that having been said and now out of the way, it is important to note that these bailouts come in the form of bilateral emergency loans. Argentina and Mongolia stand out as countries that are especially dependent on Chinese loans. These loans carry higher interest payments than what the IMF requires, but in spite of the fact that this is the case, they also have a far less stringent list of requirements.

Hence, China is able to bail out desperate countries even though it is charging a rate of interest that is higher than might have been the case otherwise. A few other countries that have been wracked with inflation such as Turkey, Pakistan and Egypt also had to resort to Chinese loans, otherwise their economic conditions would have started to spiral out of control with all things having been considered and taken into account.

China has loaned out a total of $100 billion so far in the 21st century. The trend is continuing, and even great powers like Russia have had to take loans from the East Asian nation.

The Chinese central bank often offers a liquidity swap, whereas Chinese state-owned banks are also prone to offering lines of credit. Around 40% of the loan amounts came from the former, with 60% coming from the state bank sponsored latter option.

It will be interesting to take note of the long-term effects of this trend. China has developed a reputation for stepping in and helping countries out, but they will not be willing to make any compromises once repayment is due. This could lead to a shift in the balance of power over the next few decades.

Chart: Statista

Read next: Meta Is The Least Trusted Tech Company Among UK Users, Confirms New Forbes Advisory Study

With all of that having been said and now out of the way, it is important to note that these bailouts come in the form of bilateral emergency loans. Argentina and Mongolia stand out as countries that are especially dependent on Chinese loans. These loans carry higher interest payments than what the IMF requires, but in spite of the fact that this is the case, they also have a far less stringent list of requirements.

Hence, China is able to bail out desperate countries even though it is charging a rate of interest that is higher than might have been the case otherwise. A few other countries that have been wracked with inflation such as Turkey, Pakistan and Egypt also had to resort to Chinese loans, otherwise their economic conditions would have started to spiral out of control with all things having been considered and taken into account.

China has loaned out a total of $100 billion so far in the 21st century. The trend is continuing, and even great powers like Russia have had to take loans from the East Asian nation.

The Chinese central bank often offers a liquidity swap, whereas Chinese state-owned banks are also prone to offering lines of credit. Around 40% of the loan amounts came from the former, with 60% coming from the state bank sponsored latter option.

It will be interesting to take note of the long-term effects of this trend. China has developed a reputation for stepping in and helping countries out, but they will not be willing to make any compromises once repayment is due. This could lead to a shift in the balance of power over the next few decades.

Chart: Statista

Read next: Meta Is The Least Trusted Tech Company Among UK Users, Confirms New Forbes Advisory Study